THE FUTURE OF RISK MANAGEMENT

Change of Paradigm & Cautious Confidence

DETAILED AGENDA (Download)

(Venue information and main contacts down below)

Speakers

In order of appearance

Liz Everett Krisberg

Head of Bank of America Institute

Liz Everett Krisberg is head of Bank of America Institute. With over two decades of experience at Bank of America, she previously held leadership roles within BofA Global Research and was head of Institutional Fixed Income Middle Market Sales. She has a bachelor’s degree from Cornell University and an MBA from The Wharton School. She also chairs the Athletics Advisory Council and serves on the Cornell University Council Administrative Board, Cornell SC Johnson College of Business Leadership Council, Student and Campus Life Advisory Council, President’s Council of Cornell Women, and Fraternity and Sorority Advisory Council.

Claudio Irigoyen

Head of Global Economics Research - BofA

Claudio Irigoyen is managing director and Head of Global Economics Research for BofA Global Research. In this capacity, he oversees the Global Economics Research team, coordinates global economics forecasts and reports on the global economic landscape. Prior to being named Head of Global Economics Research, Irigoyen was Head of Latin America Economics, Equities and Fixed Income and Foreign Exchange Research. He ranked number one for several years in the Latin America Institutional Investor surveys, and under his leadership, the Latin America team ranked first overall. Before joining BofA in 2011, Irigoyen served as Head of Global Macro Trading at Deutsche Bank Proprietary Trading. Prior to joining Wall Street, he served as chief economist and director of monetary policy at the Central Bank of Argentina for half a decade. Irigoyen holds a Ph.D. in economics from the University of Chicago. He is based in New York.

Thomas Gstaedtner

Head of Division, DG SIB bei European Central Bank

Thomas Gstaedtner is the President of the Supervisory Board, European Banking Institute (EBI). He has been working at the European Central Bank since May 2014 as Head of Division in DG SIB. His department is responsible for supervising 3 globally significant institutions within the Eurozone. In addition, Dr. Gstädtner is Head of the Country Coordination Team for the French Banks under ECB Supervision. Before the ECB, Dr. Gstädtner worked for Deutsche Bank AG London in different managerial positions, his last position being Head of Legal/Regulatory Change Management. Prior to that, he was Head of Legal/Tax in an asset management company and an associate in a law firm in Munich. Dr. Gstädtner is a qualified lawyer in Germany and solicitor in England/Wales. Dr. Gstädtner is also President of the European Banking Institute’s Supervisory Board.

Frank Haverkort

Supervisor - European Central Bank

Dr. Frank Haverkort has been working at the European Central Bank since Sep 2019 as Supervisor. Before, he was seconded to the Analysis and Methodological Support Division of the ECB to take part in a stress test exercise. Prior the ECB, Frank worked as an on-site inspector for De Nederlandsche Bank conducting on-sites in the areas of market risk, (counterparty) credit risk and liquidity risk, with a focus on bank's internal risk models. In addition, Frank provided support to DNB's account supervision in his expertise areas of market risk and counterparty credit risk. Frank also worked as model validator for ABN AMRO Bank. Thomas has a PhD in Theoretical Physics of the University of Groningen.

Andrew McKenna

Head of Market and Counterparty Credit Risk Supervision - Federal Reserve System

Andrew McKenna is the head of market and counterparty credit risk supervision for systemically important financial institutions in the Federal Reserve System. In this role, Andrew leads several teams with responsibility for supervision of banks’ financial risk management, stress testing and modeling practices in these areas, including monitoring of market events and the analytical program. Prior to joining the New York Fed, Andrew held a number of positions within the Federal Reserve System in stress testing, quantitative modeling and research, banking analytics, and Basel II implementation. Andrew is also an Adjunct Assistant Professor of Public Service at New York University’s Wagner School. He completed graduate studies in public administration at New York University, economics and finance at Johns Hopkins University, and undergraduate studies in economics and politics at Arizona State University, where he was the recipient of Fulbright and Boren scholarships.

Ryan Rehorn

Horizontal Team Lead - LISCC Capital Counterparty Credit Risk Horizontal Evaluation Team - Federal Reserve Bank of Richmond

Ryan Rehorn leads the LISCC Capital Program’s Counterparty Credit Risk Horizontal Evaluation Team, which is responsible for supervising counterparty credit financial risk management and controls at large and systemically important financial institutions. This includes assessments of stress testing and capital planning processes, fundamental risk management practices, and topical monitoring activities. In his 24 years at the Federal Reserve Bank of Richmond, Ryan has served in a number of roles and coordinated with numerous international groups and partners.

Shannon Bozelli

Shannon Bozelli

Head of Financial Risk for the Large and Foreign Banking Organizational group - New York Federal Reserve

Shannon Bozelli has been working for the Federal Reserve Bank of New York and is currently the Head of Financial Risk for the Large and Foreign Banking Organizational group. In this role, Shannon leads several teams with the responsibility of supervising banks’ financial risk management, including oversight of wholesale credit, counterparty credit, market, model and liquidity risks. She has also held other roles within the Federal Reserve Bank in the systemically important financial institutions group leading teams overseeing banks’ stress testing, quantitative modeling and investment portfolios. In addition to her supervisory role, Shannon was a representative on Basel taskforces participating in the re-design and implementation of the Basel II/III credit risk standards. Prior to joining the Federal Reserve Bank of New York, Shannon worked at Lehman Brothers and Deloitte structuring securitizations.

Geoffrey Greener

IFRI Board Member - Chief Risk Officer of Bank of America

Geoffrey Greener is Chief Risk Officer of Bank of America. He is responsible for overseeing the company’s governance and strategy for global risk management and compliance. Geoffrey is a member of the company’s executive management team. Geoffrey has served in a number of senior roles throughout the company, including Enterprise Capital Management executive, and Head of Global Markets Portfolio Management. Geoffrey also has chaired the Global Markets Capital Committee and the Global Banking and Markets Regulatory Reform Executive Committee. Prior to joining Bank of America in 2007, Geoffrey was a portfolio manager at Caxton Associates, where he specialized in fixed income markets and mortgage-backed securities. He began his career at Goldman Sachs, where he worked from 1987 to 1995, trading fixed income products.

Graeme Hepworth

Graeme Hepworth

Chief Risk Officer of RBC

Graeme Hepworth is a member of the Group Executive, which sets the overall strategic direction of RBC. He was appointed Chief Risk Officer in 2018. Prior to being appointed CRO, Graeme was EVP, Retail & Commercial Credit Risk, where he led a number of teams that provided the primary risk management support to RBC’s Insurance, Wealth Management and Personal and Commercial Banking (P&CB) businesses. Graeme joined RBC in 1997 as an analyst in Group Risk Management, focusing on foreign exchange products. In 2001, he took on the role of Vice President for GRM's Portfolio Management team which was focused on loan portfolio risk analysis, economic capital and policy. Graeme moved to New York in 2004 to become Head of Market Risk for the Capital Markets trading businesses in the U.S. In 2011, Graeme moved to London to take on the role as Chief Risk Officer for Europe & Asia. Graeme is a qualified Chartered Financial Analyst and has a Masters in Mathematics from the University of Waterloo.

Gopala Narayanan

Gopala Narayanan

Senior Vice President - Enterprise Risk Management - RBC

Gopala Narayanan is Senior Vice President of Enterprise Risk, Gops is a member of the Group Risk Management (GRM) Operating Committee and leads the Enterprise Risk management practice at RBC. Based out of Toronto, his responsibilities include defining and evolving RBC’s risk appetite, leading the bank’s stress testing and loss provisioning programs to ensure financial resiliency, developing banking and trading book models, and establishing the ESG Risk Management practice. Gops joined RBC in 2010 and has held progressively senior roles across operations, sales, and credit risk management, including executive responsibilities within the Personal and Commercial Banking division and Group Risk Management function. Prior to RBC, Gops worked at a global financial institution in roles across the United States and India. Gops holds an MBA from the Indian Institute of Management, a Master’s degree in Biosciences, and a Bachelor’s degree in Chemical Engineering. He is a champion for Diversity and Inclusion (D&I), serving as a member of RBC’s Enterprise Diversity Leadership Committee and as the Executive Sponsor for GRM’s D&I Council.

Jennifer Livingstone

Vice President for Climate Strategy - RBC

Jennifer Livingstone oversees RBC’s efforts to accelerate the transition to a greener economy. Since 2022, Jenn and her team have helped establish RBC’s enterprise-wide climate plan, formalized the bank’s approach to assess its energy clients’ plans and support their actions toward a net-zero future, and solidified the bank’s commitment to triple its lending to renewable energy by 2030 and allocate $1 billion to climate solutions. Jenn brings over 15 years of international experience in Climate, Finance, and ESG to RBC. She has a Masters in International Affairs from Columbia University, a Bachelors of Commerce from Queens University, as well as a CMA designation.

Nazneen Rajani

Founder and CEO at Collinear AI

Dr. Nazneen Rajani is the founder and CEO of Collinear AI, which is focused on AI safety and alignment as a service for the enterprise. Until recently, she was a Research lead at Hugging Face and worked on the Zephyr model, the open-source equivalent of ChatGPT. Her work on Safety alignment using Reinforcement Learning from Human Feedback (RLHF) has been featured in the NYT. Before Hugging Face, Nazneen led a team of researchers at Salesforce on controllable and interpretable language models. She obtained her Doctorate in Computer Science from the University of Texas at Austin, with a research focus on Natural Language Processing (NLP) and the interpretability of Machine Learning models. She boasts a publication record of over 40 articles in prominent conferences such as the ACL, EMNLP, NAACL, NeurIPS, and ICLR. Her research has received significant attention from reputable media outlets, including the New York Times and Quanta magazine. Nazneen serves on the UN's AI advisory board, has contributed to NIST's AI risk management framework, and advises Meta on their responsible release and use of the LLaMA models.

..

Sriram Raghavan

Sriram Raghavan

Vice President - IBM Research AI

Sriram Raghavan is Vice President at IBM Research for AI (artificial intelligence). In this role, he leads a worldwide team of over 750 research scientists and engineers across all IBM Research locations who are advancing the field of AI and accelerating its applications to the digital transformation of enterprises. Sriram is responsible for establishing and executing a wide-ranging research agenda that spans foundational and applied AI. He also has overall responsibility for the R&D portfolio and transfer of technology from IBM Research to IBM’s multi-billion-dollar software business. Prior to his current role, Sriram was the Director of the IBM Research Lab in India and the CTO for IBM in India/South Asia. Sriram began his career in IBM at the Almaden Research Center in San Jose, California, USA where he led a variety of research efforts in natural language processing, data management, and distributed systems. Sriram is an alumnus of Stanford University, USA and the Indian Institute of Technology, Chennai, India. He is a recipient of multiple IBM Corporate and IBM Research Accomplishment Awards and a member of the technical advisory board of the Robert Bosch Center for Data Science & AI.

Sid Nadella

Director of Financial Services - Google Cloud

Sid Nadella leads the global capital markets practice in the strategic industries team at Google Cloud. With over two decades of experience in capital markets, he has been instrumental in developing and scaling groundbreaking products and businesses. Prior to Google, his professional journey began and predominantly unfolded at Goldman Sachs, where he served as a front office strat (quantitative engineer) and trader. His role there involved spearheading projects that created pioneering products in a dynamic and regulatory intensive environment, offering him a distinct insight into the fusion of technology and innovation within a highly regulated industry. Later, he took on key roles at Symphony Communications, leading their solutions division, and at LiquidNet.

Cyril Voisin

Cyril Voisin

EMEA Customer Security Officer Manager at Microsoft, M12 Startup Expert Advisor

Cyril Voisin leads a team of EMEA Customer Security Officers (CSO) at Microsoft, a group of former CISOs and senior security practitioners. He and his team address the CxOs (CISOs, CIOs, CROs, CDOs) of the most strategic customers to help them achieve their cybersecurity goals. Cyril is pivotal in building and fostering strong security partnerships as well as leading critical cybersecurity initiatives. Cyril has been working with Microsoft for about 27 years in various roles. He is a frequent speaker at cybersecurity events, for instance AI Risk Management keynote at Microsoft Security Days. Cyril holds a Master from a leading Technology Institute, Arts et Métiers in Paris. He’s also certified by Microsoft on data science and Artificial Intelligence, and was one of the first Copilot for Security champions.

Art Lindo

Art Lindo

Deputy Director at Federal Reserves Board’s Division of Supervision and Regulation

Arthur Lindo (Art) is the Deputy Director for Policy in the Federal Reserve Board's Division of Supervision and Regulation. His principal responsibilities include overseeing the development and assessment of the effectiveness of Board regulations and policies affecting the financial services sector and coordinating the Board’s domestic and international regulatory programs. He also advises the Board on emerging policy matters that have implications for the supervision and regulation of the financial services sector. He is an active participant in various committees in the Federal Reserve System, U.S. banking sector and international financial sector standard-setting bodies and is the previous chair of BCBS Operational Resilience Group and current chair of the workstream on Third Party Risk Management. Art has a BA in Accounting from the Catholic University of America and an MBA in Finance from the George Washington University.

Jason Healey

Jason Healey

Senior Research Scholar, Cyber Conflict Studies - SIPA Columbia University

Jason Healey is a Senior Research Scholar at Columbia University’s School for International and Public Affairs specializing in cyber risk and conflict. He is the editor of the first history of conflict in cyberspace, A Fierce Domain: Cyber Conflict, 1986 to 2012. Jason was a founding member of both the Office of the National Cyber Director at the White House (2022) and the first cyber command in the world, the Joint Task Force for Computer Network Defense in 1998, where he was one of the early pioneers of cyber threat intelligence. During an earlier job in the White House, he was a director for cyber policy, coordinating efforts to secure US cyberspace and critical infrastructure. He created Goldman Sachs’ first cyber incident response capability and later oversaw the bank’s crisis management and business continuity in Asia. He served as the vice chair of the Financial Services Information Sharing and Analysis Center (FS-ISAC). He is on the review board of the DEF CON and Black Hat hacker conferences, served on the Defense Science Board task force on cyber deterrence, and is past president and founding board member of the Cyber Conflict Studies Association. He started his career as a US Air Force intelligence officer with jobs at the Pentagon and National Security Agency.

Jayaraj Puthanveedu

Jayaraj Puthanveedu

Head of Cyber ,Operational Resilience, Anti Fraud and Third-Party Tech Risks - BNP Paribas

Jayaraj Puthanveedu (more easily known as Jay) has 25 years of industry experience in the fields of Risk Management, Cybersecurity, Technology Risk, and Resilience. Currently, he is in charge of Resilience, Cyber/Digital Fraud, and Third Party Technology Risk at BNP Paribas Group. In this role, Jay spearheads strategic initiatives to fortify the organization's resilience against evolving threat landscape. His responsibilities include developing and implementing robust risk management frameworks, collaborating with cross-functional teams, and driving risk transformation efforts in the areas of operational resilience, cyber, tech risk and digital fraud topics while ensuring regulatory compliance.

In the past, Jay has held various leadership and senior technical roles in Goldman Sachs, Northern Trust and Deutsche Bank. He actively contributes to industry forums and collaboration efforts. As part of World Economic Forum’s Global Agenda Council on Risk and Resilience, Jay co-authored the paper on “Systemic Nature of Cyber” and currently serves as the Member of Board of Directors in FSISAC Europe

Venue Information

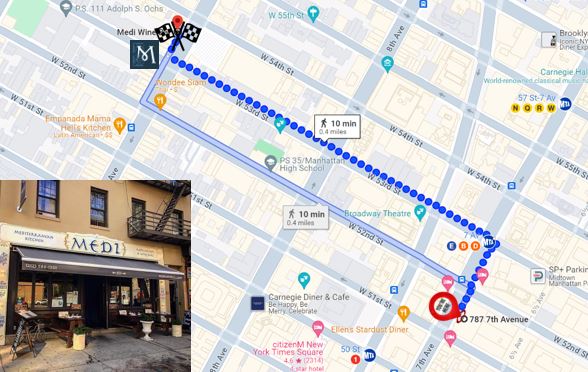

IFRI Annual Roundtable 2024 will take place at

BNP Paribas premises - 787 7th Ave, New York - US

Dinner will take place at restaurant MEDI Winebar

811 9th Ave, New York (10min walk from the IFRI roundtable location)

Mediterranean Fusion Cuisine - Medi Wine Bar, Cellar and Garden

Main contacts for the IFRI Annual Roundtable 2024

Nedjma Bellakhdar - Chief of Staff to Group CRO - BNP Paribas

(+352) 621 527 591

Email nedjma.bellakhdar@bnpparibas.com